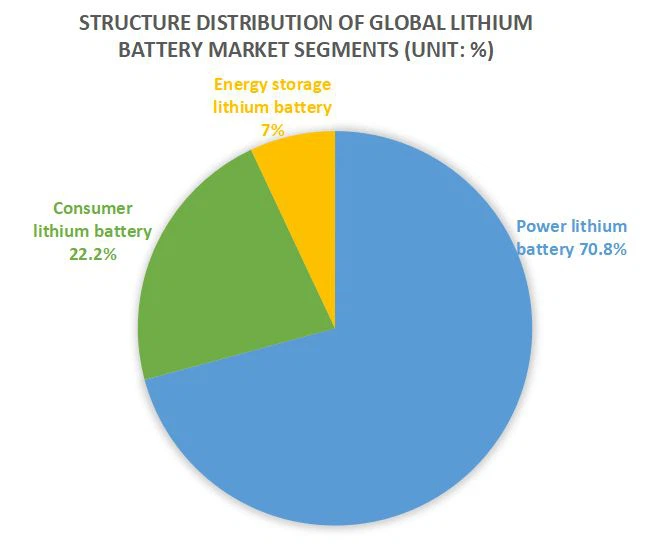

The global market share of power lithium batteries and energy storage lithium batteries has increased significantly, and the proportion of consumer lithium batteries has continued to rise.

The lithium battery market

mainly includes power lithium batteries, energy storage lithium batteries, and

consumer lithium batteries.

Power lithium battery mainly

used in new energy vehicles. The application field of energy storage lithium

battery is a power system.

The application field of consumer lithium batteries is mainly consumer electronics such as mobile phones. Global lithium battery production data show that power lithium battery production reached 70.8%, accounting for the top share. The second is consumer lithium batteries, with a market share of 22.2%. The market share of energy storage batteries is only 7%. It is worth noting that with the proposal of the "carbon neutralization" strategy, global lithium battery companies actively deploy the production lines of energy storage lithium batteries. Both the vigorous development of new energy vehicles and the energy storage market is conducive to the further improvement of energy storage lithium batteries.

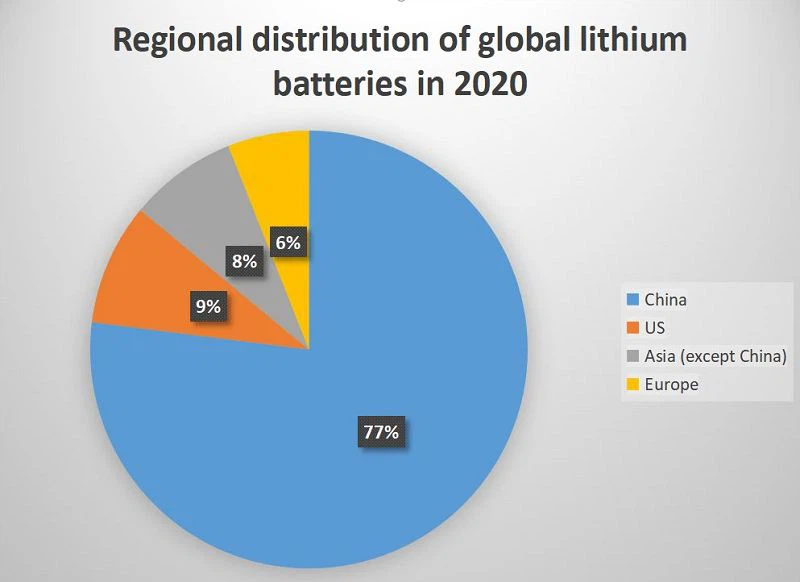

The global lithium battery area is mainly distributed in China, accounting for 77%; the United States ranks second, and Europe is expanding rapidly.

According to data released by

S&P Global Market Intelligence, China dominates the global lithium-ion

manufacturing market in terms of production capacity. China's lithium-ion

battery production capacity accounts for 77% of the world, followed by the United

States, which accounts for about 9%. According to S&P Global Market

Intelligence, China will continue to be the leading country in lithium-ion

battery manufacturing in 2025. With Europe's planned investment in energy

storage, capacity expects to expand significantly. In 2025, Europe will become the

world's second-largest lithium-ion battery production region, accounting for

about 25% of global.

The world's leading lithium battery companies LG Chem, Panasonic, and CATL have a total market share of 70%.

From the perspective of enterprise output, the world's leading lithium-ion battery manufacturers (CATL, LG Chem, Panasonic) have a significant competitive landscape. Among the top five global lithium-ion battery manufacturers, there are two Chinese companies, CATL and BYD.

The number of global lithium

battery factories is rapidly growing.

In the context of the new crown epidemic, the number of lithium-ion factories in different planning and construction stages continues to increase compared with the previous year. Among them, most factories are in China.

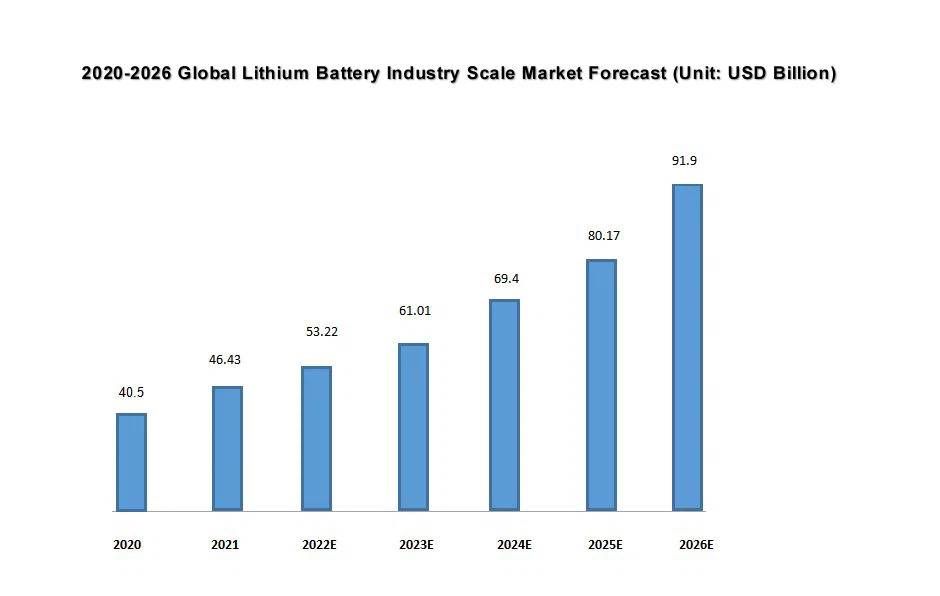

The global lithium battery

market expects to be double-scale by 2025.

According to Research and

Markets data, the market expects to grow at a GACR of 14.6% in 2026, reaching

nearly $92 billion, more than double the market size in 2020.